Ram Fincorp’s Personal Loan App, developed by R.K. Bansal Finance Private Limited, is an RBI-registered Non-Banking Financial Company (NBFC) that offers instant personal loans to salaried professionals in India.

After personally testing the app, I discovered several hidden charges, misleading claims, and unfair practices that make this app highly unreliable. If you’re considering applying for a loan through RamFincorp, read this review before making any decision.

False Advertising and Misleading Claims

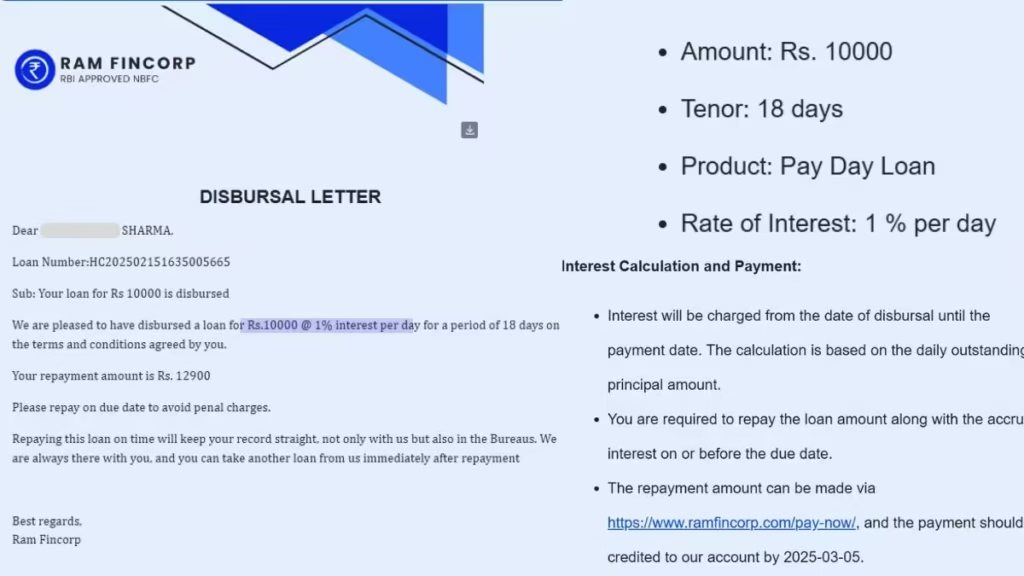

RamFincorp claims to offer instant loans ranging from ₹5,000 to ₹2,00,000 with an annual interest rate of 30%. However, my experience with the app tells a completely different story.

When I applied for a loan, despite having a CIBIL score of 789, I was only approved for ₹10,000—far lower than the promised loan amount. This shows that the company does not actually approve high-value loans, regardless of the applicant’s creditworthiness.

Moreover, the interest rate mentioned on the app is completely misleading. Instead of charging 30% annually, they charged me 1% per day, which translates to 365% annual interest! This is a huge scam, and most borrowers fall into a debt trap without realizing the actual cost of borrowing.

Unreasonable Processing Fees & Hidden Charges

Another major issue with RamFincorp is its exorbitant processing fees. When I took a loan of ₹10,000, they deducted ₹1,200 as processing fees, leaving me with only ₹8,820 in my account. This means you lose a big chunk of your loan amount before even using it.

Additionally, they do not clearly mention these deductions beforehand, leading borrowers into a financial shock when they receive a lower amount than expected. Such unethical practices make the app highly untrustworthy.

Short Loan Tenure & Heavy Penalties

Unlike other NBFCs that offer 3 months to 1-year repayment options, RamFincorp provided me with only 25 days to repay the loan! This extremely short tenure makes it very difficult for borrowers to arrange funds for repayment.

If you fail to repay on time, the penalties are massive, and the app starts harassing borrowers with aggressive recovery tactics.

Harassment & Unethical Recovery Practices

One of the most disturbing aspects of RamFincorp is its harassment of borrowers. If you miss even a single EMI, their agents start calling repeatedly—not just you, but also your friends and family.

Many users have complained that they received threatening calls and were publicly shamed for non-payment, which is completely illegal and unethical. This raises serious concerns about the company’s business practices.

Poor Customer Support & No Transparency

Another big issue with RamFincorp is its terrible customer support. If you face any issue with repayment, loan approval, or account details, their support team is unresponsive and unhelpful.

There is no clear communication regarding charges, and no proper resolution for customer complaints. Many users have struggled to contact their support team, only to be ignored or given misleading responses.