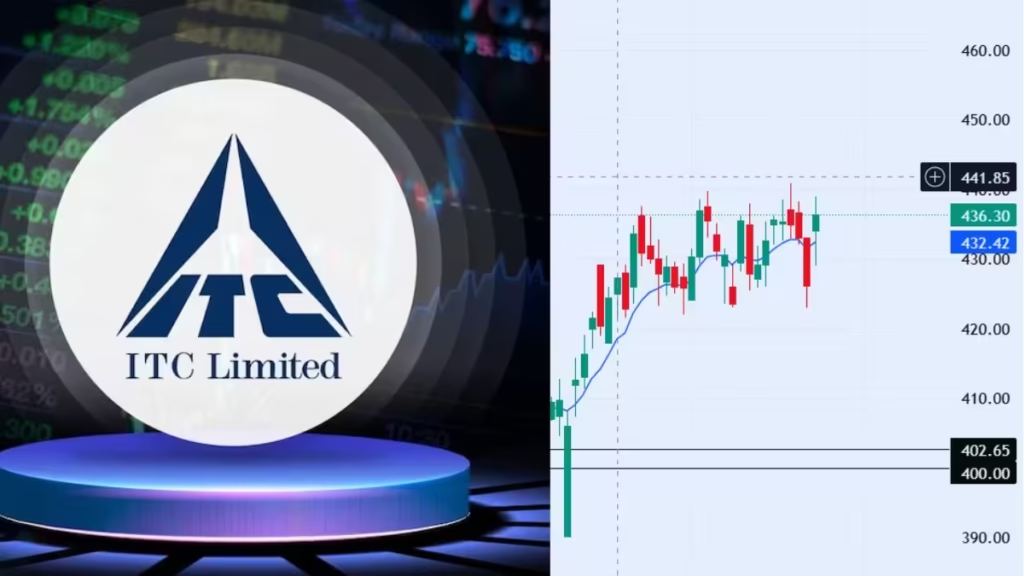

ITC Ltd.’s stock is gaining traction among investors as technical charts and analyst reports suggest a potential upward movement in the coming months. The FMCG-to-hotel conglomerate’s shares closed at ₹436.30 in the last trading session, marking an intraday gain of 2.39% (₹10.20), signaling renewed buying interest.

Sideways Consolidation Nears Breakout

After a month of moving sideways, ITC’s stock is now holding strong support at its 9-day Exponential Moving Average (EMA), a key technical indicator that often precedes bullish momentum. Market experts believe this consolidation phase could soon give way to a decisive uptrend.

“The stock has been building a strong base around ₹430–435 levels,” said Rajesh Sharma, a technical analyst at TradeWell Securities. “A sustained move above ₹440 could trigger a fresh rally, with initial targets near ₹465 and eventually ₹500 in the medium term.”

Analysts Bullish on Long-Term Growth

Several brokerages have raised their price targets for ITC, citing strong fundamentals and improving sectoral trends:

- Motilal Oswal maintains a ‘Buy’ rating with a target of ₹575, citing robust performance in ITC’s FMCG and cigarette divisions.

- Antique Broking revised its target to ₹563, highlighting the company’s diversified revenue streams and stable cash flows.

- Short-term traders are eyeing ₹500 as an achievable level if bullish momentum sustains.

Fundamentals Support the Optimism

Beyond technicals, ITC’s financial health remains strong:

- Dividend Yield: Attractive at 3.15%, making it a favorite among income investors.

- Q4 FY25 Earnings: Reported an EPS of ₹15.77, beating estimates, with revenue expected to grow further.

- ROE (Return on Equity): An impressive 49.61%, reflecting efficient capital management.

Risks to Watch

While the outlook appears positive, challenges remain:

- Regulatory Risks: Potential tax hikes on tobacco products could impact margins.

- Market Sentiment: Broader economic conditions may influence short-term price action.

What Should Investors Do?

- Short-term traders could look for a breakout above ₹440 with a stop-loss near ₹425.

- Long-term investors may consider accumulating on dips, given ITC’s strong fundamentals and defensive appeal.

Disclaimer: This analysis is for informational purposes only. Investors should conduct their own research or consult a financial advisor before making decisions.