Signing the back of a cheque might seem like a small step, but skipping it can cause big problems. Whether you’re depositing or cashing it, endorsing a cheque properly is key to ensuring a smooth banking experience.

What Does Signing the Back of a Cheque Mean?

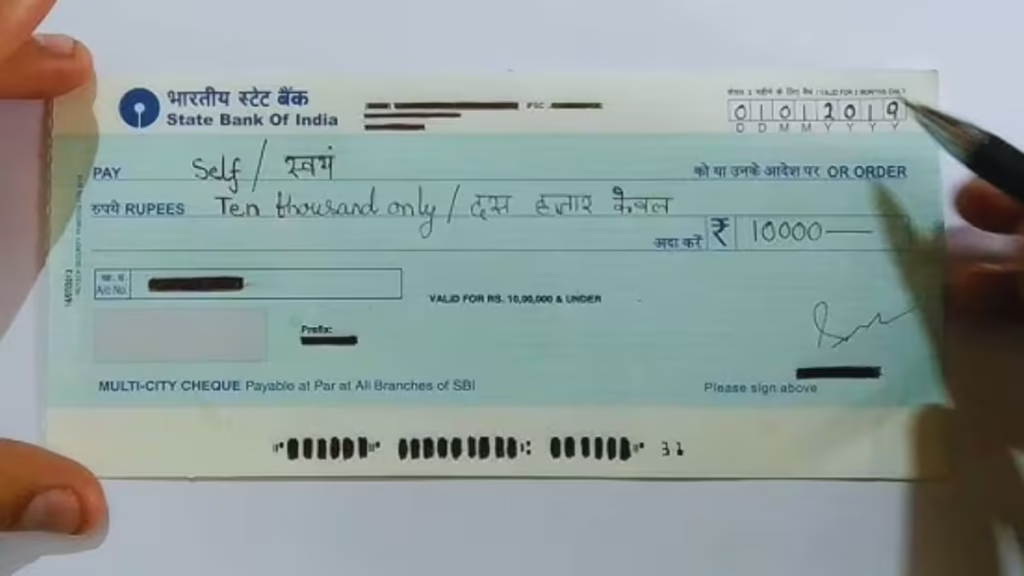

When you sign the back of a cheque, you’re officially giving your bank permission to deposit or cash it. This process is called cheque endorsement. Without your signature, the bank may reject the cheque or delay processing it.

Why It’s Necessary

Here’s why signing matters so much:

- Proof of Identity: Your signature helps the bank verify you’re the legitimate recipient.

- Prevents Fraud: Without an endorsement, anyone could attempt to misuse the cheque.

- Avoids Rejection: Many banks won’t process a cheque unless it’s properly signed.

Think of it like receiving a package — if you don’t sign for it, the delivery person won’t hand it over. Similarly, the bank needs your “okay” in writing.

Common Mistakes to Avoid

It’s easy to make simple errors that can cost you money or cause delays. Here are a few:

- Forgetting to sign the back

- Using a different signature than what’s on file

- Writing unnecessary personal info that could be a security risk

Quick Tip:

If you’re depositing through an ATM or mobile app, some banks also require you to write “For Deposit Only” alongside your signature.

Read also: Build ₹2 Crore in 25 Years Using the 12-12-25 SIP Formula